Drivers using a company-owned car for private journeys pay a monthly Benefit-in-Kind charge. This is calculated using a CO2-weighted percentage of the vehicle’s list price (or P11d), and rate of income tax. BiK has historically been very low for electric cars to encourage the uptake of low emissions vehicles as the UK moves towards decarbonising transport.

Before 2021, EVs were exempt from paying any BiK tax. The rate went up to 1% in April 2021, and changed again in April 2022 to 2%. This is still a fraction of the amount of tax drivers of petrol, diesel and hybrid cars pay. The 2% rate is fixed until April 2025 and then will increase by 1% each year until 2028. For more information please visit the Government website.

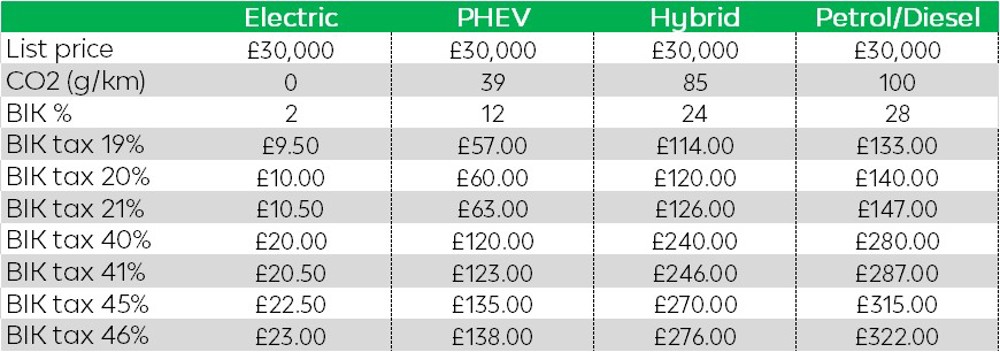

A combination of lower fuel costs and significant tax savings make Electric cars the obvious choice. Use our BIK illustrator below to see how much you could save on tax and fuel.

An illustrative example showing the annual cost of Petrol, Diesel, Hybrid & PHEV vehicles compared with Electric. The PHEV calculation assumes electric range of 30-39 miles.

Please use our calculator to obtain an exact BIK calculation for your vehicle. This will provide the tax view for this year as well as all subsequent tax years to show you your annual and monthly BIK obligations. Simply select the fuel type, enter the list price for your prospective vehicle and select your income tax rate to see the results.